The latest auto price decrease by the California manufacturer remains controversial because it may have far-reaching consequences for other manufacturers. New evidence from Reuters suggests that Elon Musk would have initiated the EV price war by exploiting the company's monopoly on the profitable electric vehicle market.

The firm capitalized on an early lead in the growing electric vehicle sector to save expenses and boost earnings upon its market debut. Even if prices drop, this strategy is expected to be profitable for Elon Musk's company because the market will soon be swamped with new zero-emission competitors.

A recent Reuters report estimates that Tesla's gross profit per vehicle in the third quarter of 2022 was $15,653. That's four times as much as Toyota and five times as much as Ford produces of any one model combined.

The US company has put a lot of money into keeping production costs low, and there is where they have gained the upper hand. The automaker kept prices low thanks to deploying new assembly-line equipment, mega presses, in-house battery manufacture, and design standardization.

Despite this, in 2022, Tesla hiked prices on their products multiple times to maximize earnings despite the pandemic. However, it was consistent with the sector as a whole in this regard, as supply chains were clogged and volume was challenging to maximize.

When supply lines are back up and running at full speed, and costs start to drop again, Tesla will have another ace up its sleeve. She now has more room to lower prices due to his increased profits, and he has begun to do so.

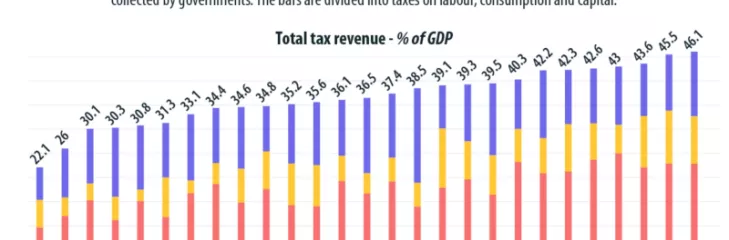

In the following years, when the supply of electric vehicles is likely to exceed demand, this will be an invaluable asset to the brand's marketing strategy. The automotive industry predicts that 2.8 million electric vehicles will be purchased yearly in North America by 2026. However, enough electric vehicle facilities will be operational to produce over 4.5 million vehicles yearly.

Tesla may be trying to scare off competitors that aren't able to match price cuts by lowering their own. Furthermore, the brand has already started implementing this strategy in China, where government subsidies are drying up, and production capacity is high.

Local rivals like Xpeng have been forced to lower their prices with Tesla. However, the manufacturer reported a net loss of $11,735 per vehicle in the third quarter of 2023 due to rising production costs, resulting in a gross income of only $4,565.

Although large automakers like Volkswagen, Ford, and General Motors have combustion vehicles and a broader product offering, they have needed more time to optimize their EV manufacturing processes, which could make it difficult for them to keep up an aggressive competition in pricing.